Recent Amendments in Companies Act, 2013: A step towards streamlined corporate compliance

Published on: 26-Jun-25

Read On: Bar & Bench

Recent Amendments in Companies Act, 2013: A step towards streamlined corporate compliance

The Companies Act, 2013 is a law that helps manage how companies in India are formed, run, and regulated. Since it came into effect, the Ministry of Corporate Affairs has made several changes to it to keep up with the changing needs of businesses and to make rules easier to follow.

The most recent amendments aim to make it simpler for companies to do business, improve transparency, and ensure that companies follow good governance practices. These changes also help protect investors and make sure that companies are more responsible in how they work.

In this article, we will look at the latest updates to the Companies Act, 2013 in May 2025 and June 2025.

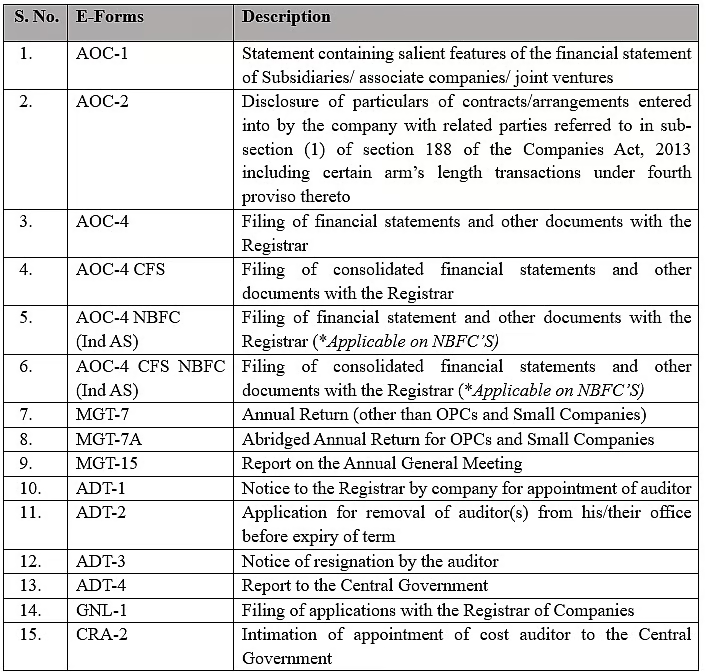

Migration of e-Forms from Version 2 to Version 3 Portal

In a major push towards digitization and structured data management, MCA has transferred several e-Forms from the Version 2 (V2) portal to the Version 3 (V3) portal. The following forms have been migrated:

Step-by-Step Breakdown of the 2025 Company Rules Amendments

The following rules have been amended by the Ministry of Corporate Affairs through various notifications issued in May and June 2025:

- Companies (Accounts) Rules, 2014

- Companies (Management and Administration) Rules 2014

- Companies (Audit and Auditor) Rules, 2014

- Companies (Cost Records and Audit) Rules, 2014

- Companies (Registration Offices and Fees) Rules, 2014

- Companies (Filing of Documents and Forms in Extensible Business Reporting Language) Rules, 2015

1. Companies (Accounts) Amendment Rules, 2025 (Notification dated May 19, 2025)

Extended CSR-2 Filing Deadline: The MCA has further extended the deadline for filing e-Form CSR-2 for the financial year 2023–24. Initially, the filing deadline was December 31, 2024, but pursuant to Companies (Accounts) Second Amendment Rules, 2024, MCA has amended the timeline to March 31, 2025, and now by introducing Companies (Accounts) Amendment Rules, 2025 it has now been further extended to June 30, 2025.

2. Companies (Accounts) Second Amendment Rules, 2025 (Notification dated May 30, 2025)

a) Enhanced Disclosures in the Board Report

i. Reporting on Sexual Harassment Complaints: In clause (x) of sub rule (5) of rule 8 of Companies (Accounts) Rules, 2014 (this “Rules”), the disclosures pertaining to Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act 2013, the Companies now need to provide more detailed disclosures including:

- Number of complaints of sexual harassment received in the year;

- Number of complaints disposed off during the year; and

- Number of cases pending for more than ninety days.

ii. Reporting on Maternity Belief Act, 1961: After clause (xii) of sub rule (5) of rule 8 of this Rules, a new clause (xiii) is inserted requiring a statement by the company with respect to compliance with the provisions relating to Maternity Belief Act, 1961.

b) Introduction of new e-Forms for key extracts

After sub rule (1B) of rule (12) of this Rules, sub rule (1C) is inserted, which requires filing of following e-Forms along with other relevant primary financial statement e-Forms:

- Extract of Board Report

- Extract of Auditor’s Report (Standalone)

- Extract of Auditor’s Report (Consolidated)

c) MCA migrated the forms from Version 2 (V2) portal to Version 3 (V3) portal

In view of making data and filings more structured and digitalized, MCA transfers the e-Form no. AOC-1, AOC-2, AOC-4, AOC-4 CFS, AOC-4 NBFC (Ind AS), AOC-4 CFS NBFC (Ind AS) from V2 portal to V3 portal. Additionally, three new e-Forms have been introduced for more efficient analysis by authorities, namely the extract of the board report, extract of the auditor’s report (both standalone and consolidated).

3. Companies (Management and Administration) Amendment Rules 2025 (Notification dated May 30, 2025)

MCA has transferred e-Form no. MGT-7, MGT-7A, MGT-15 from V2 portal to V3 portal through these rules.

4. Companies (Audit and Auditor) Amendment Rules, 2025 (Notification dated May 30, 2025)

Via these rules, MCA transferred the e-Form no. ADT-1, ADT-2, ADT-3, ADT-4 from V2 portal to V3 portal.

5. Companies (Cost Records and Audit) Amendment Rules, 2025 (Notification dated May 30, 2025)

MCA transferred the e-Form no. CRA-2 from V2 portal to V3 portal through these rules.

6. Companies (Registration Offices and Fees) Amendment Rules, 2025 (Notification dated May 30, 2025)

Through these rules, MCA transferred e-Form no. GNL-1 from V2 portal to V3 portal

7. Companies (Filing of Documents and Forms in Extensible Business Reporting Language) Amendment Rules, 2025 (Notification dated June 06, 2025)

The MCA has inserted sub rule (1A) after rule (1) in rule 3 of Companies (Filing of Documents and Forms in Extensible Business Reporting Language) Rules, 2015 which requires the companies to attach copy of signed financial statements duly authenticated in pdf format in e-Form AOC-4 XBRL.

Conclusion

The introduction of more detailed disclosures in board report, introduction of various e-Forms and transfer of company-related forms from the V2 to the V3 portal under the Companies Act, 2013 is a significant step towards modernizing corporate compliance in India. These amendments are aimed at improving efficiency, enhancing user experience, and ensuring faster processing of forms through a more advanced and user-friendly digital platform. While companies and professionals may face initial challenges in adapting to the new system, the long-term benefits of transparency, ease of filing, and reduced delays are expected to outweigh the short-term difficulties. Overall, this change reflects the government’s commitment to digital transformation and ease of doing business in the corporate sector.

Authors: Sanika Mehra, Mona Gupta